By Cristiane Quartaroli

Year after year, we return to discussing confidence, as we believe that it is one of the most important indicators of a country’s economy. The confidence and expectations of entrepreneurs and the population reflect the level of optimism or pessimism, pointing to consumption and investment trends – two fundamental factors to boost economic activity and the labor market. When they are optimistic, entrepreneurs tend to make investments and consumers are more likely to buy. Increases in investment and consumption fuel economic growth and job creation. In times of pessimism, investments and consumption decrease, slowing down economic activity. The opposite is also true. But where are we currently when it comes to trust?

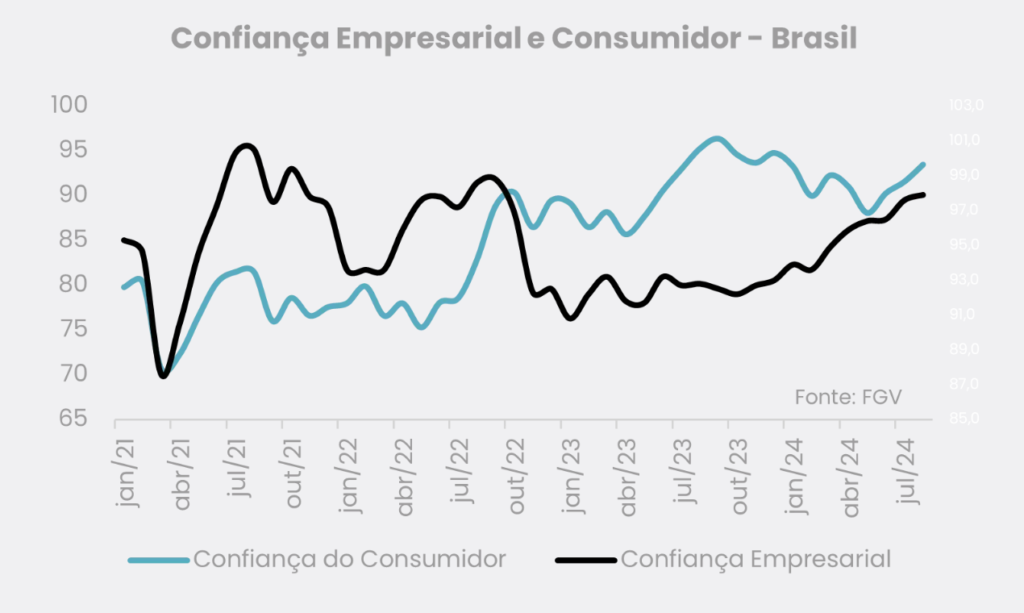

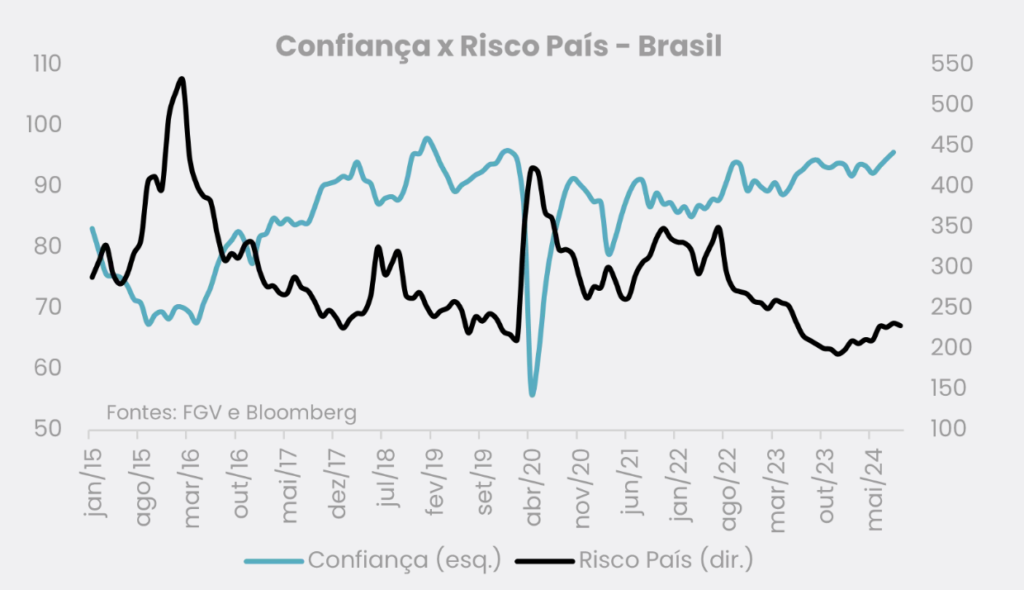

Not that we are in a perfect and problem-free scenario, as there are still many issues to be addressed in Brazil (hello fiscal!!) and we are in an election year – here and in the US – which brings an additional uncertainty factor, as well as a lot of emotion (and puts emotion in it). But the fact is that the confidence indicators released recently signaled a significant recovery, both when analyzed from the perspective of entrepreneurs and through the lens of the consumer (see graph). Which is still good news. Reductions in inflation and interest rates played a key role in improving consumer perception; On the business side, the fall in inflation also helps, but the progress – albeit timid – of some structural reforms contributed to the evolution of these indicators.

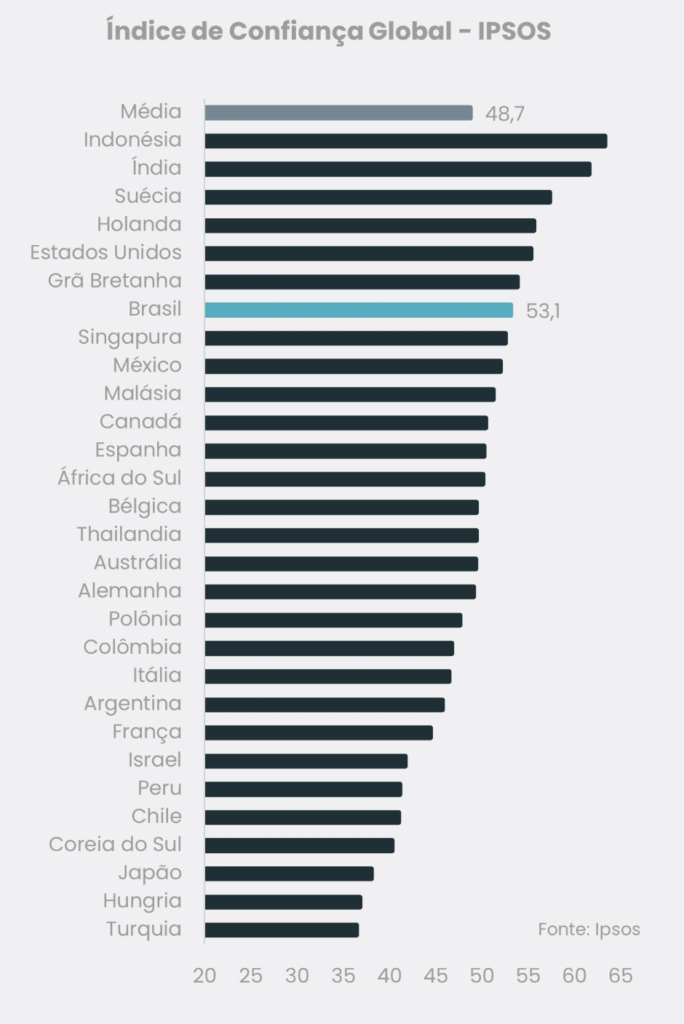

It is worth noting that, according to a survey by the company Ipsos – which monthly monitors the attitude of consumers in 29 countries – Brazil is now the eighth country where the level of consumer confidence was highest in August (see graph), below the position it occupied at the same time last year (2nd place), but still, in a very good positioning. Brazil’s result is also above the average of the 29 countries considered in the survey. Namely: this survey has a significant scope, as it has the participation of more than 21 thousand people, from 29 markets (countries). It is conducted on Ipsos’ Global Advisor online research platform and released monthly by Refinitiv as the Primary Consumer Sentiment Index (PCSI).

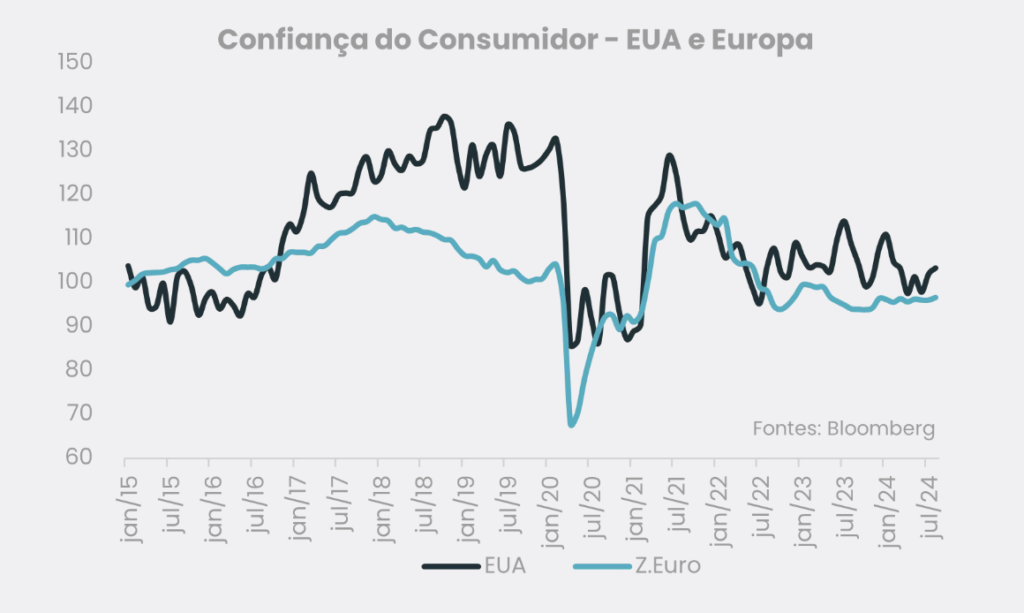

In addition, Eurozone and US confidence indicators remain at levels below those observed before the pandemic (see chart). These are important economies that are still suffering from the highest interest rate level by historical standards. Although both have started the cycle of interest rate cuts and inflation is subsidence in these countries, it still seems to be little enough to reflect positively on confidence indicators. The Fed’s interest rate cut at the September meeting is expected to have a positive impact on confidence indicators that will be released in the coming months.

We must be aware of the fact that an improvement in a country’s confidence can influence several variables, such as country risk and even the exchange rate (and vice versa!). When looking at the graph, it is noted that trust and country risk behave like magnets with opposite polarities – when confidence is low, country risk increases, and the reverse also occurs. It is worth remembering that country risk is an indicator that reflects the degree of market confidence in the economy and in a nation’s ability to pay. Thus, as business and consumer confidence improves, country risk tends to decrease, which can have a positive impact on both the exchange rate and the overall perception of the country. Since the beginning of this year, the risk has been worsening even in an environment with a higher level of confidence. The lack of predictability with the fiscal issue is one of the main reasons for this. Is this the trend for the coming months or will the improvement in confidence be enough to positively impact country risk? Let’s wait for the scenes of the next chapters!

Conclusion: it is still too early to say, after all, confidence is good, but too much confidence can also get in the way and, in the case of the economy, can lead agents to make hasty decisions. So, calm down at this time. For now, we are going through a moment of caution, with elections approaching, interest rates that have risen again here in Brazil and reduced capital flow due to doubts involving the fiscal issue. What will happen from now on will depend a lot on the conduct of the country’s monetary/fiscal policy and how this will be received by the population and businessmen – who will reassess whether they remain confident or not.