By Cristiane Quartaroli

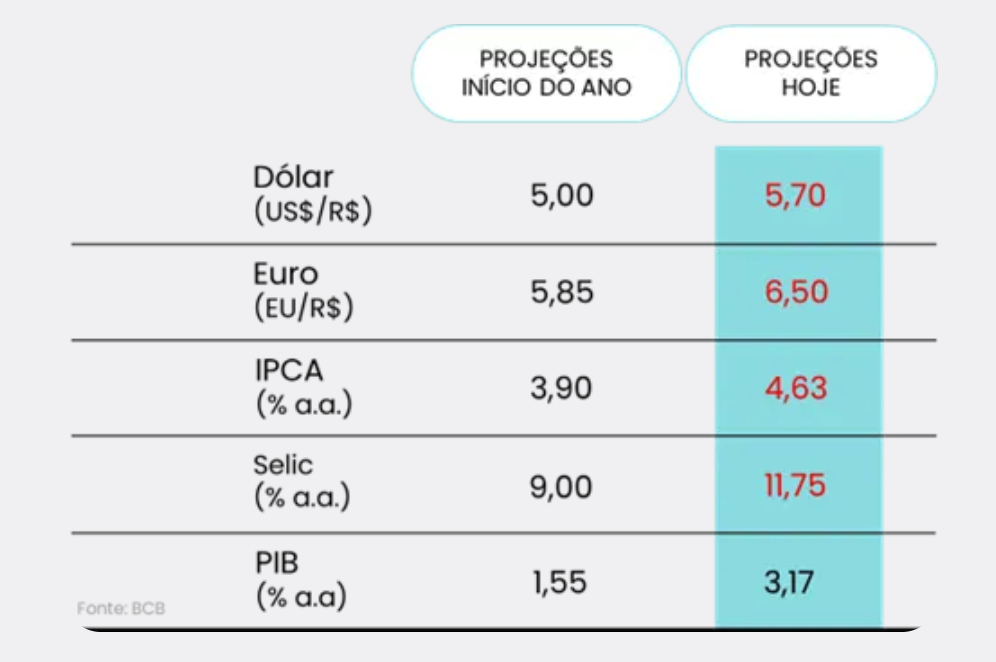

2024, took us by surprise. If we look at the report we wrote at the end of 2023 with the outlook for this year, we will see that both we and the other market analysts had a more positive view and that was not very well what happened. We were negatively surprised in the most varied aspects of our economy. The exchange rate has become more pressured, inflation has risen and the interest rate, which was supposed to end the year below 2 digits, will end the year very close to 12% p.a., with expectations of rising even more. The only exception and positive surprise was economic growth, which, once again, was much higher than what the market projected at the beginning of the year (see table below). Understanding where we went wrong (in everything… nervous laughter) and trying to decipher what might happen from now on will be the arduous task of economists for the coming months, shall we?

The situation is so out of order that it even seems that we are living through another pandemic. Not in the health sense of the thing, but in the sense that everything seems messy, out of place, as we said in the title of this report. Starting with the international scenario. We have two wars underway – in Eastern Europe and in the Middle East – and, although they do not have a direct impact on our economy, they are events that affect the general order of the world, bringing uncertainty and volatility to financial assets. In addition, they affect the prices of commodities that are widely traded raw materials that are essential to the world economy. To give you an idea, commodities represent more than 60% of our exports. In other words, in some way we are affected by this geopolitical issue, even if indirectly.

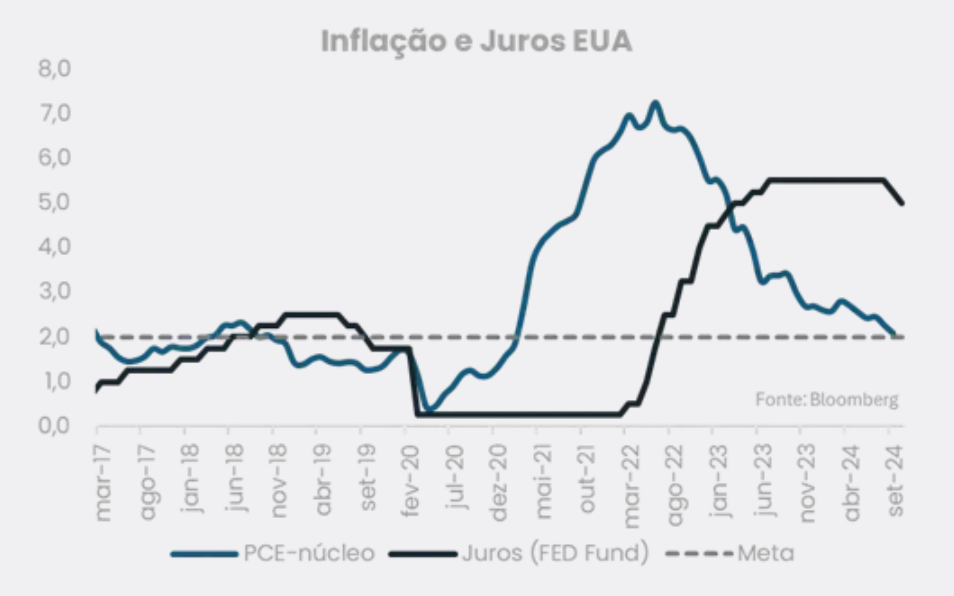

In addition, we will have challenges and fears to face for our two main trading partners – the US and China and the two together, all mixed up, but separated and quarrelled, and a possible new trade war. In the US, the big question from 2025 will be the conduct of the country by the hands of the new President Donald Trump. The expectation of an ultra-conservative and protectionist policy tends to favor the American economy (and only them), generating greater economic momentum (only for them), more inflation and, consequently, more interest rates. In short, this is the expectation and the impact of this for emerging markets is pressure on exchange rates, which are already under a lot of pressure, by the way. Remembering that today, both inflation and American interest rates are falling (see chart) and a reversal in this movement can indeed be quite bad.

Added to this is the expectation of lower Chinese growth which, mind you, dear reader… it is not that we are talking about a growth of 1%, but something closer to 5% and that it is still little for the great world power called China, used to growing, on average, 8% each year (see graph). The slowdown in the Asian country’s economic growth could have significant consequences for the world economy, increasing the risk of recession. For Brazil, the lower demand from China, which is now our largest consumer of agricultural and mineral products, for Brazilian products impacts exporters and may limit our economic growth (but I don’t know if we are too worried about this, we will see later).

If looking outside the clutter seems to be great, when we look inside, we are not very well-organized either. As we said at the beginning of the report – the projections have already been better. The inflationary picture is what worries the most, as it is what can trigger a staggered worsening for the other variables. Consumer inflation today is running at around 6.0% and expectations for 2025 and 2026 are not encouraging at all, both are above the target. As the renowned economist José Roberto Mendonça de Barros mentioned in a recent article, “the worsening of expectations in the economy is close to becoming a fait accompli”. Will we have difficult years ahead?

Remembering that our exchange rate has already risen more than 20% since the beginning of the year and there are no signs of improvement. A high exchange rate for a long time is synonymous with inflation, we have seen this in the not-so-recent past. In other words, the fact may even be consummated and, as a result, the Central Bank will be forced to raise the Selic even more (which is already high again), as shown by market projections. Exchange rates, inflation and skyrocketing interest rates are the main ingredients for the projections of lower growth from next year to materialize. So it is difficult to disagree with the words of Mendonça de Barros. We were once more optimistic, it’s true, but it seems that the fuel of positivity is running out.

This is without going into detail about the fiscal scenario, which we have already commented on in other reports throughout the year, and which will still give us many reasons for future discussions and concerns. Today, in addition to not helping, it is getting in the way. In other words, 2025 should be an even more challenging year, full of many uncertainties and a continuous and strange disorder, as if we were facing something that began to rise, but was never completed. Or, continuing the lyrics of the song that gave the title to this report “here everything seems that it was still construction and is already ruin”.