By Cristiane Quartaroli

The process of humility that every economist undergoes throughout life is constant. There are so many variables, some successes, and many mistakes, that it feels like you are walking on a tightrope all the time, and at any moment, a gust of wind can knock you down. Some colleagues learn from this, others not so much (nervous laughter). It is about this randomness that we will talk about today, as we recently had another unforeseen event that made most economists recalculate their route or, for the more academic ones, include another dummy variable in their models. Just another normal day in the life of an economist!

For those who read the last report, you know that not everything was perfect. We mentioned the external scenario, with American interest rates still high, the Chinese economy growing little, and a messy fiscal situation here in Brazil. On the other hand, there was a positive macroeconomic backdrop for Brazil, with easing inflation, lower interest rates than we had a year ago, and therefore, an economy showing more resilience.

May arrived, and it seems that even the title of the last report would fit almost perfectly in this one as well, after all, water became a central theme in our country this month, with the floods in Rio Grande do Sul.

Of course, human losses and environmental damage are much more important than any financial value lost in this tragedy. However, it is also very important to understand how this event will affect Brazil’s economy, as Rio Grande do Sul represents about 6.5% of our GDP, and in one way or another, there will be an impact on certain areas of our economy.

And here we are, economists, in another exercise of humility, reviewing projections and reassessing scenarios after a random and practically impossible-to-predict factor. And with that, we will list below some impacts that, in our view, seem more significant at this first moment:

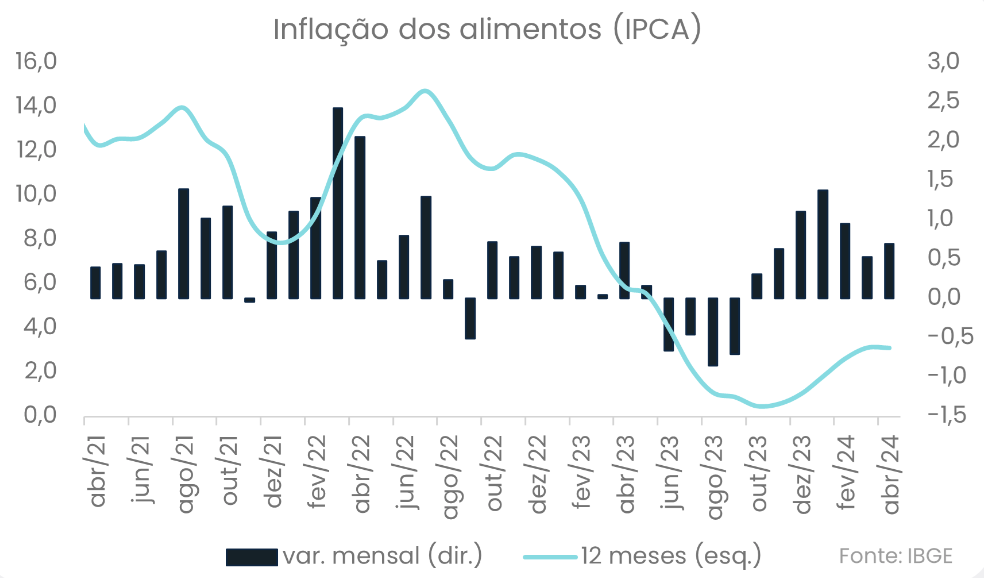

The first of them concerns a possible impact on inflation projections. Remember: we were in a scenario of improving inflation indicators, with core measures easing and the latest monthly results showing some positive surprises. However, food inflation had returned to being pressured (see chart), and the floods in the southern region of the country tend to aggravate this scenario.

To give you an idea, Rio Grande do Sul is responsible for about 70% of rice production, which may have been severely affected due to climatic events. But rice has a small weight in the IPCA (0.78 p.p.), so the effect tends to be reduced. On the other hand, the state also has a significant share in soybean and meat production – products that have a greater weight in inflation indicators.

Again, the effects also tend to be reduced, as it is estimated that the soybean harvest had already been practically completed, and specialists believe that livestock losses tend to result in price increases only locally. In other words, we will have a negative but small impact on our inflation scenario for this year. Projections were slightly revised upwards, according to the latest Focus report – from 3.73% to 3.80% last month.

Effects on Economic Growth Are Harder to Measure. The most evident impacts are linked to agriculture, especially rice production – which was the crop most affected by the rains. It is worth noting that, according to experts, it is estimated that rice cultivation represents about 1% of the total GDP of Rio Grande do Sul, meaning it is a relatively low value, so the impact on our total growth tends to be small.

On the other hand, besides agriculture, the logistics sector also faces and will continue to face challenges in the short and medium term. Many highways, essential for the flow of production, were flooded or destroyed, interrupting the normal flow of goods transportation and causing delays and losses.

The halt in industrial production due to direct damage to factories or the interruption in the supply of raw materials is also a major concern, as it can lead to a cascading effect, affecting industries in other parts of Brazil that depend on supplies produced in Rio Grande do Sul.

In other words, although it is estimated that the total impacts on our growth are small and diluted over time, projections have already started to be revised downward. According to the latest Focus update, there was a reduction in our GDP projection from 2.09% to 2.05%.

Finally, it is worth highlighting the possible impacts on public accounts. Although the importance of all aid destined to the state is understood, there is a fiscal cost because of this. Among the measures already announced are:

1.Possible suspension of the debt collection of the State of Rio Grande do Sul with the Union for three years;

2.A package of measures that could reach R$ 51 billion, including advance payments of benefits such as Bolsa Família, gas aid, salary bonus, income tax refund, among others;

3.Reconstruction aid of R$ 5,000 per registered family, which will cost R$ 1.2 billion to public coffers.

In other words, all these measures are essential to rebuild Rio Grande do Sul — but they have the potential to worsen the Brazilian fiscal situation, which was already suffering before the crisis caused by the climatic event. It is worth noting that some of the public expenditures will be excluded from the government’s fiscal rules, the famous “fiscal framework,” because Rio Grande do Sul is in a state of calamity.

Therefore, that zero deficit target that the government projected for the end of this year and which was already distant, is becoming even more so. And the Focus projections have also changed for the worse. According to the latest Focus, the market increased the primary deficit projection from -0.64% to -0.70%.

Conclusion: it is still too early to actually predict what the impacts of this natural disaster will be on our economy as a whole. Considering that the state of Rio Grande do Sul has an important participation in our GDP, as mentioned at the beginning of the report, the revisions in the projections may even be modest. We will only know with the passage of time.

And once again, we randomly conclude that unforeseen events are the foundation of every economist’s humility.