By Cristiane Quartaroli

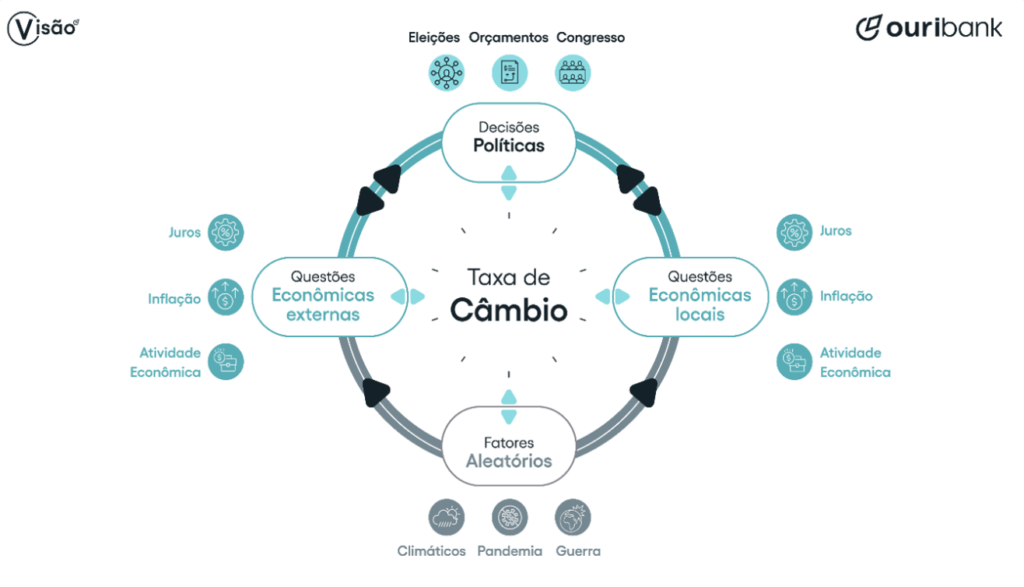

When we think about the macroeconomic scenario, we usually look at numerous variables (see Figure 1), all of which are interconnected and dependent on each other. Some have greater relevance (or weight, as economists like to say), while others have less, but we cannot disregard any of them. The evolution of the exchange rate, for example, which is one of our favorite topics, depends on many variables, among which we highlight local and external economic issues, political decisions, and random and unpredictable factors that are always ready to show up!

In the July report, we detailed the positive and negative points that could make our exchange rate fluctuate to a lower or higher level. Just over a month later, the numbers and the range of this uncertainty seem to have not changed much. Some variables that appeared along the way brought more doubts, while others cleared up the blurry vision of the past. That said, what to expect for the coming months?

Starting with external economic issues, we will highlight three main points:

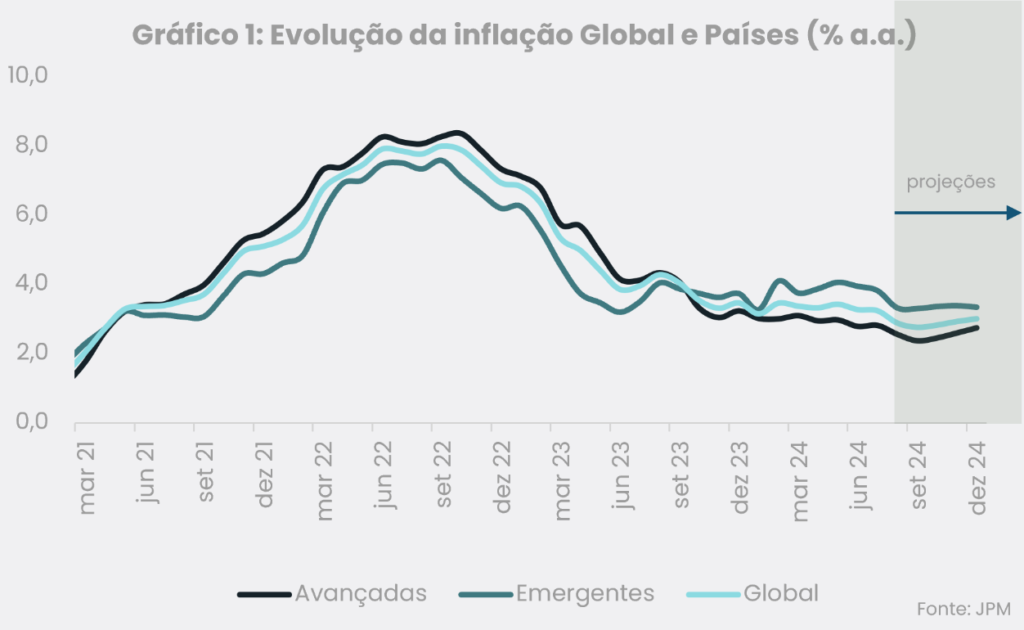

1. We are currently experiencing a global inflation slowdown that has allowed for a less contractionary monetary policy stance in various countries (see Figure 1). This movement had already been visible in emerging economies since last year and is now also seen in advanced economies. A more recent example is the Eurozone, which has begun its cycle of interest rate cuts.

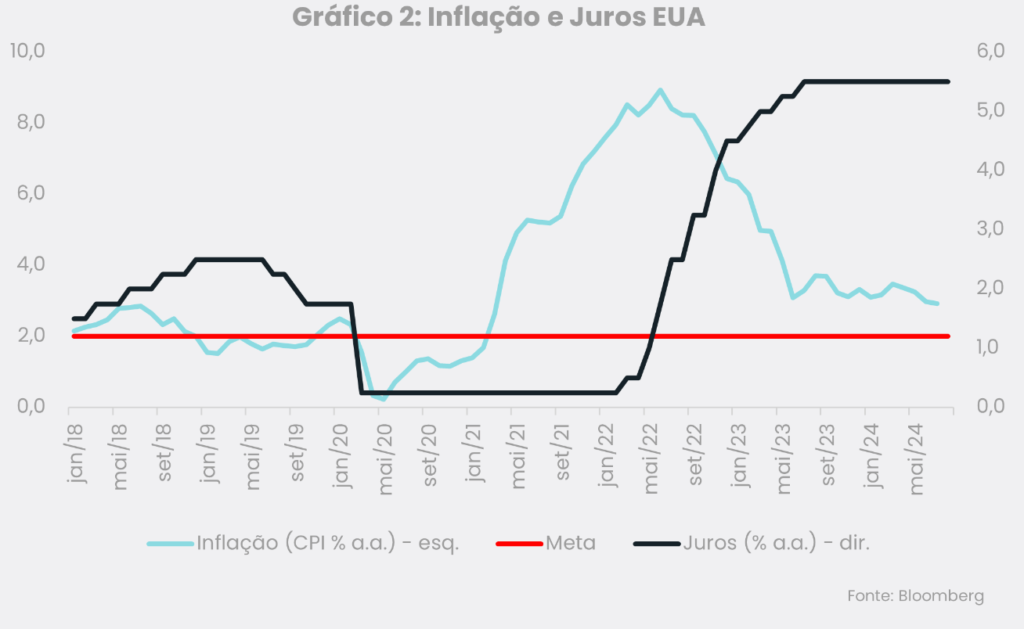

2. American inflation has eased and is now close to the target level (2.0%) – this, combined with the fact that U.S. economic activity has been gradually reducing (still far from a recession scenario, as recently warned), will allow the FED (Federal Reserve) to follow the same path as Europe and start the interest rate cut cycle from September (see Figure 2).

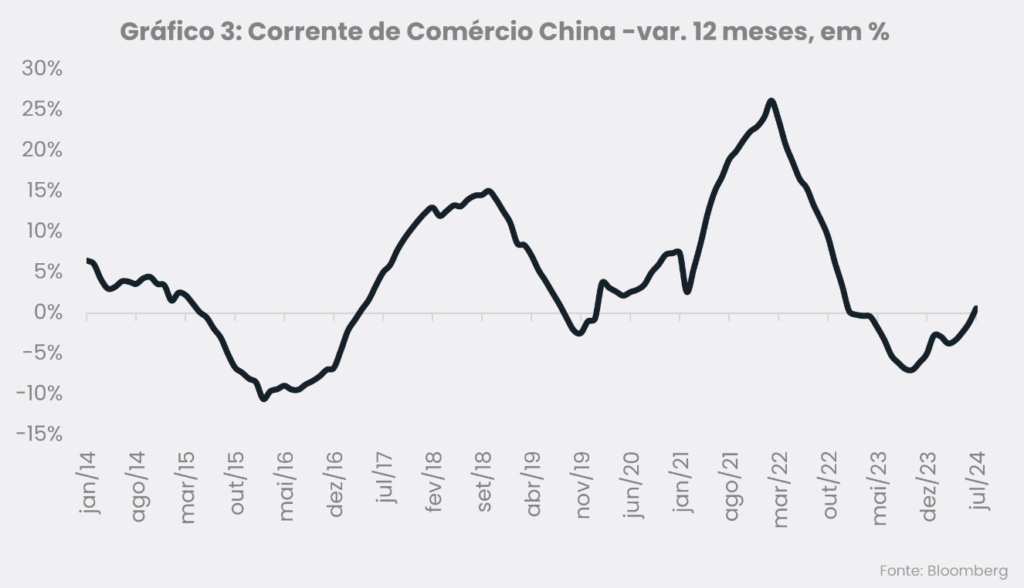

3. Finally, and no less important, we have China, which is our large and relevant trading partner. Although the data on the level of economic activity is still uncertain and shows that Chinese growth may be slightly weaker by the end of this year, foreign trade seems to be recovering more significantly. After a long period, Chinese trade flow is returning to positive territory (see Figure 3), and this tends to be good for Brazil and other emerging economies.

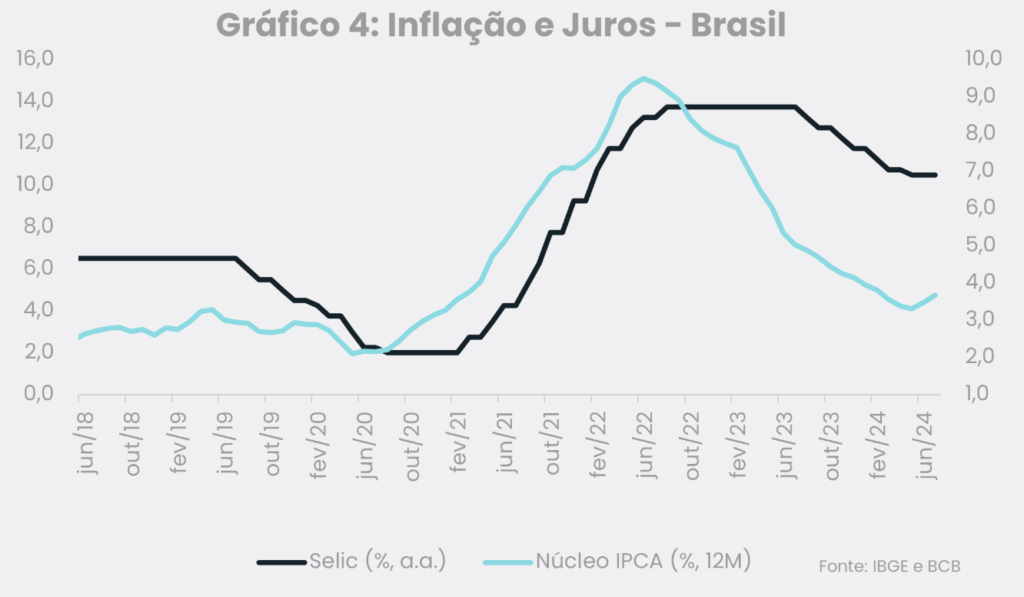

Moving now to internal economic issues. We can say that we have good fundamentals. The Selic rate is currently at a lower level than it was 1-2 years ago (the next move by the Central Bank is indeed in question, but the overall picture is still more favorable); inflation has also significantly decreased over the past year (see Chart 4), and economic activity has been surprisingly positive since the beginning of the year. Do we have weaknesses? Yes, we do. And these could undermine all the recent improvements.

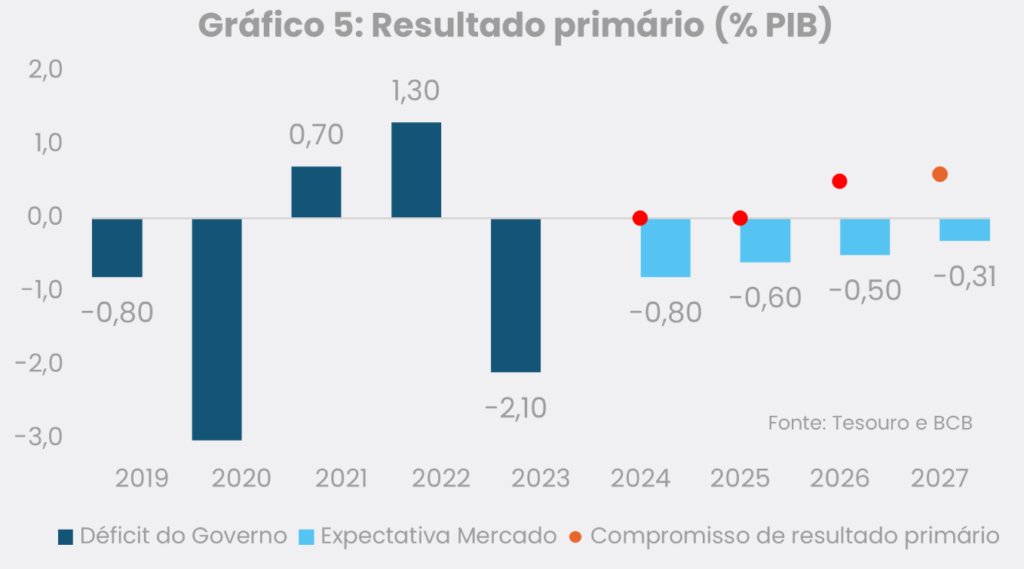

We are talking about the future of Brazilian fiscal accounts. There are doubts regarding the government’s ability to meet fiscal targets. We have a government with an expansionist fiscal profile (big spender, right?!) and we are not seeing any effective measures that could reverse this situation. On the contrary, to balance the budget, that is, to eliminate the fiscal deficit, the measures proposed so far only aim at increasing revenue and not cutting expenses. This alone may not be sufficient. The market does not believe in this (see Chart 5). Remember that we still have municipal elections this year, which could complicate discussions about spending cuts in Congress.

Conclusion: Well, having said all that, the conclusion we reach is always the same. It is too early to assess what the exchange rate level will be at the end of this year. We would even say that it is practically impossible to reach a more precise conclusion. But we continue to believe in a more optimistic bias, thinking that the good external and internal fundamentals will outweigh the ups and downs that are likely to occur along the way. The variables of the half-full glass seem to be balanced with the variables of the half-empty glass, all mixed together. A month later, we still prefer to count on the luck of a more stable scenario.