By Cristiane Quartaroli

Are we exaggerating, having a blurry vision or living reality as it is? When we look only and exclusively at the assets of the financial market, both local and international, the impression we have is that the world is collapsing and no one noticed! The exchange rate has already risen more than 16% throughout this year and it was not only here in Brazil, other emerging currencies have also depreciated equally or a little less. The stock market indices have oscillated more than sea with a hangover and the yield curves continue at a high level and rising, upwards and forwards. As a result, the perception of risk, which had improved a lot until April of this year, has worsened significantly in recent months, see the chart.

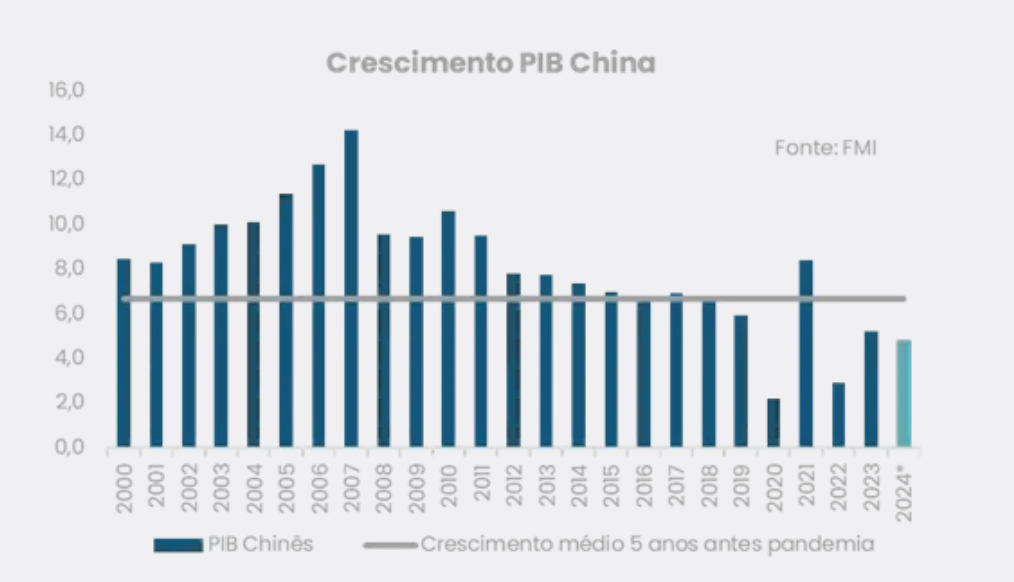

There is no shortage of reasons for so much “risk aversion” – as experts, economists, taxi drivers and sympathizers say – nowadays everyone has an opinion, right? There is indeed a perception of a generalized global worsening due to the expectation that interest rates may rise again worldwide, especially in the US considered one of the world’s great powers (alongside the not so friendly China). And speaking of China, the expectation of lower Chinese growth has also been a reason for discussion and an additional point of aversion to global risk, since today there is talk of growth of “only” 5.0% for the Asian giant this year. But look at how crazy (or would it be an exaggeration?). There is a collective hysteria about China’s low growth, and we are talking about an economy that is expected to grow around 5.0% – of course it is a low value for a country that used to grow between 6.0 and 8.0% p.a. before the pandemic (see chart).

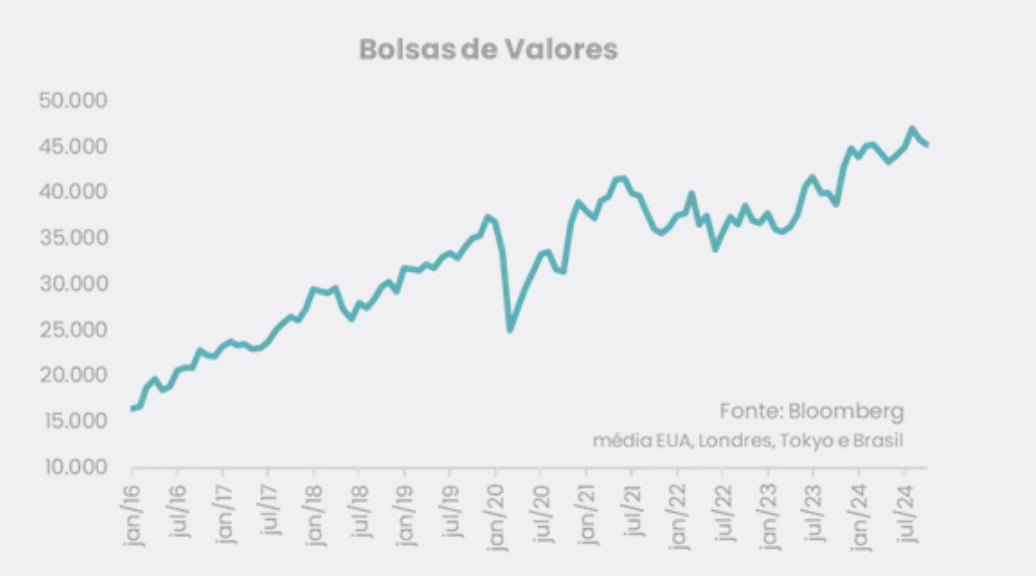

But if we think about all the restrictive measures over the last few years, 5.0% seems like a good percentage, don’t you think? What about the stock market indices we mentioned above? It’s okay that they gave in a little recently, but they are still all at a very comfortable level (see graph). The same can be said of the yield curves, which, of course, may not even be at the lowest level in history in some countries, but are still at a lower level than they were two years ago. In other words, it seems that there is indeed an exaggeration (or would it be madness?).

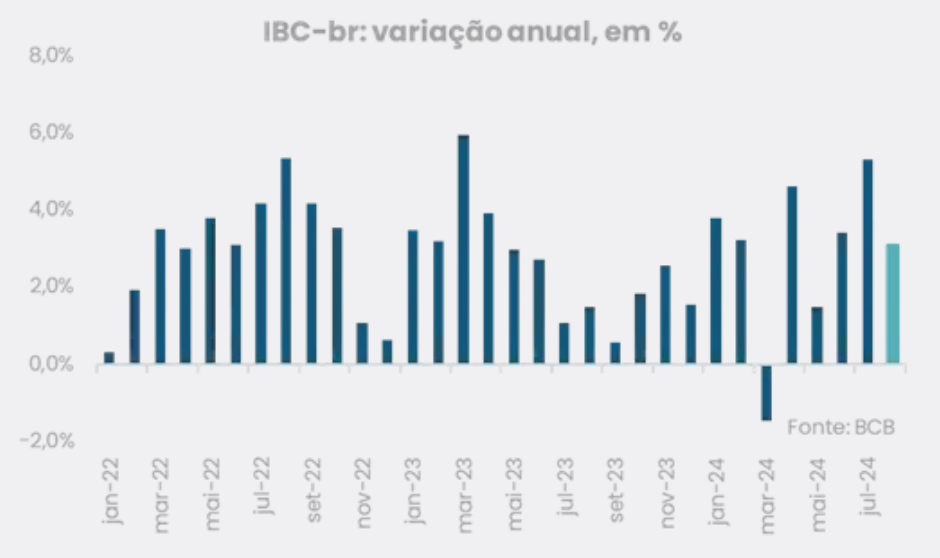

Now, looking only at our own navel, or rather, at our manly Brazil, the reality of most macroeconomic indicators seems to be far from all the exaggeration and/or madness we mentioned above. You see, dear reader, our economic growth has been positively surprising with each new indicator. The recently released IBC-br, with data for the month of August, showed growth of 3.1% in the year (see chart) and contributed to boost the growth projections for the end of this year. Remembering that at the beginning of the year, the Central Bank’s Focus survey – which brings together economists’ projections – pointed to a measly growth of 1.5%. Today, estimates are above 3.0%. It is worth noting that even the IMF revised Brazilian growth to 3.5% in a report released this week. It is the resilience of the Brazilian economy speaking louder.

In addition, our inflation has subsided. Although the most recent data show a less positive evolution, we have to agree that we are talking today about inflation below what we observed a year ago, for example. Today, the cumulative IPCA in 12 months is running at around 4.50% while at the beginning of 2023 it was around 5.80%. Our interest rate is the same. Although it rose again at the last Copom meeting, our basic interest rate today stands at 10.75% p.a. compared to 13.50% p.a. when it reached its peak in 2023. In short, we are growing more, with inflation and lower interest rates. But then why don’t assets reflect this macroeconomic improvement?

Conclusion: Hard to say. We know that the market adjusts expectations and today we have some issues that are not yet well resolved – American elections, War in the Middle East and the fiscal scenario in Brazil. In other words, expectations are poorly anchored due to themes that permeate uncertainty, and uncertainty generates volatility and risk aversion. In fact, we will only know later if it was all an exaggeration, madness or if reality should have prevailed as absolute truth.