By Cristiane Quartaroli

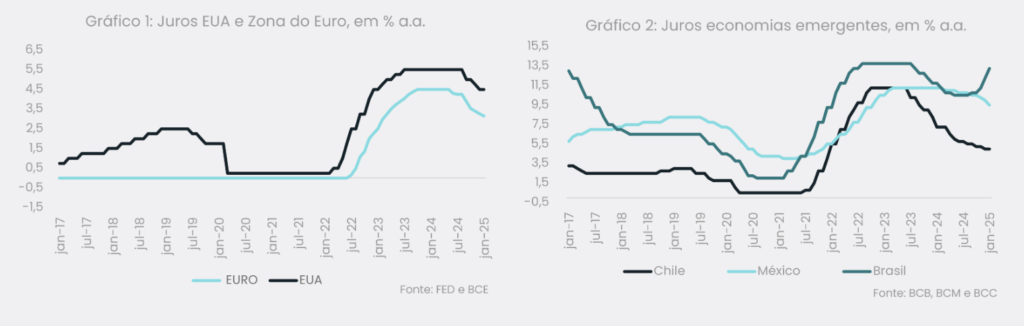

Year in, year out and the subject of interest rates continues to predominate in the circles of economists, congressmen, analysts and, of course, taxi drivers! And this year is no different, as the subject of the time continues to be how the evolution of interest rates in major economies, especially the US – after all, we are talking about the world’s largest power. Remembering that the interest rate is one of the pillars of any country’s monetary policy and directly impacts several sectors of the global economy. While some economies have already started the cycle of lowering interest rates (see graphs 1 and 2), others are going against the grain (hello Brazil!) and, in the US, the most likely hypothesis is that of maintenance, but with some doubt in the air.

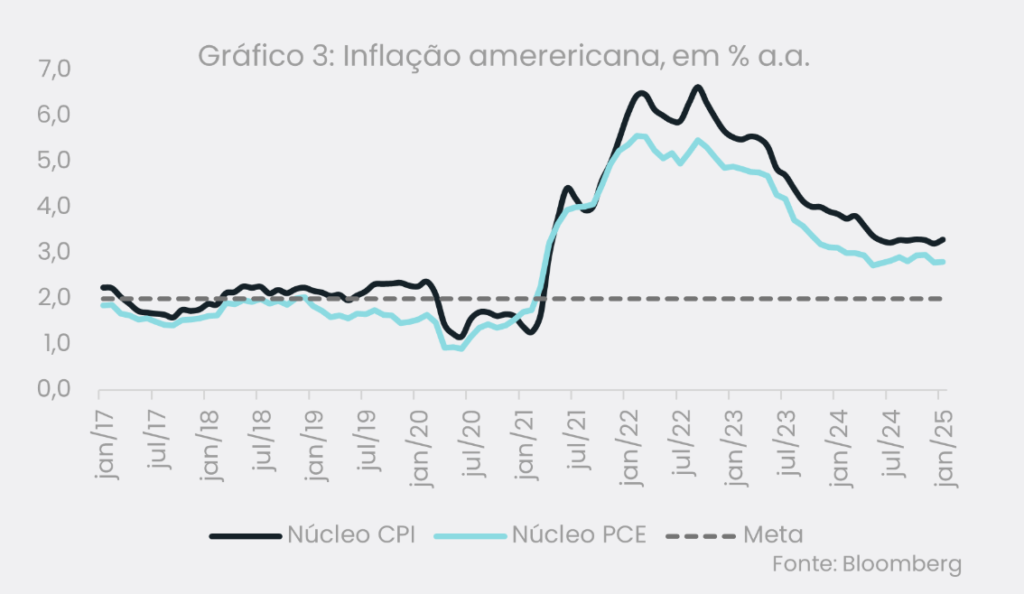

It is worth remembering that at the end of last year the American Central Bank made a move to reduce interest rates in the December decision. However, the fall was interrupted in the first decision of 2025 due to inflationary persistence and the economy still heated, let’s see:

1. US inflation seems to be letting up. The most recent indicators released in the US surprised again in a negative way. Both the PCE (Personal Consumption Price Index) and the CPI (Consumer Inflation) had better-than-expected results and show annual inflation still above the established target, which is 2.0%. To give you an idea, annual inflation measured by the CPI rose again in January this year to 3.0% compared to the 2.9% observed in December. The core – which excludes food and energy items – remained at the level of 3.3% in the annual comparison, both well above the target. The core PCE also remains high (see chart 3).

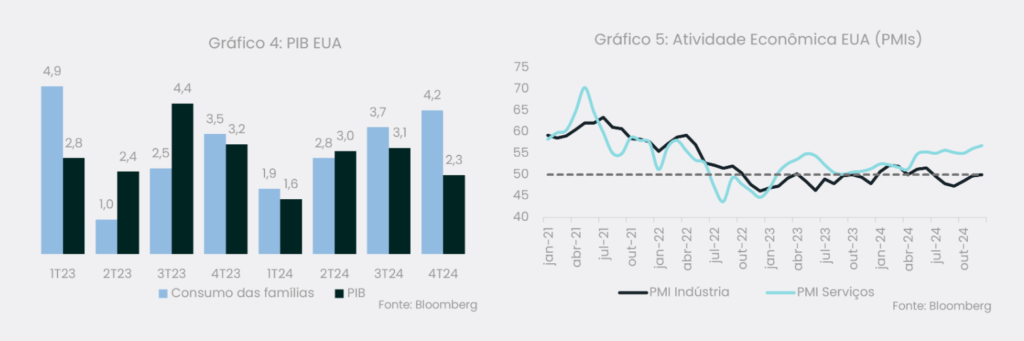

2. Economic activity, in turn, continues to strengthen. Although the US GDP registered a lower growth in 2024, compared to 2023, it was still an advance that exceeded the initial expectations, of 2.3% p.a., with a strong participation of household consumption (see chart 4). Likewise, labor market indicators continue to strengthen, signaling a picture of economic activity that is still quite heated. To give you an idea, although the unemployment rate is at a high level by American standards (4.0%) and the indicator of open positions in the economy has slowed down recently, we are still talking about a level far from the time when the economy was not in recession. In addition, jobless claims have been slowing down since October last year. The same goes for PMI indicators, which remain above 50 points – a level that signals an expanding economy (see graphs 5).

Given these factors, the vast majority of hypotheses focus on a reduction of only 25 p.p. for US interest rates throughout this year, taking the rate to the range of 4.25% – 4.50% by the end of 2025 (the current base rate is between 4.50% and 4.75%). Remembering that, according to the Fed monitor, calculated by the investing.com, in mid-2024, about 50% of the sample indicated a sharper drop by the end of the year. However, more recent projections suggest only a cut as mentioned above. There are also those who consider the possibility that the Federal Reserve will not make any more cuts throughout 2025, especially due to the trade and protectionist policies of the new government, in addition to other political-economic uncertainties.

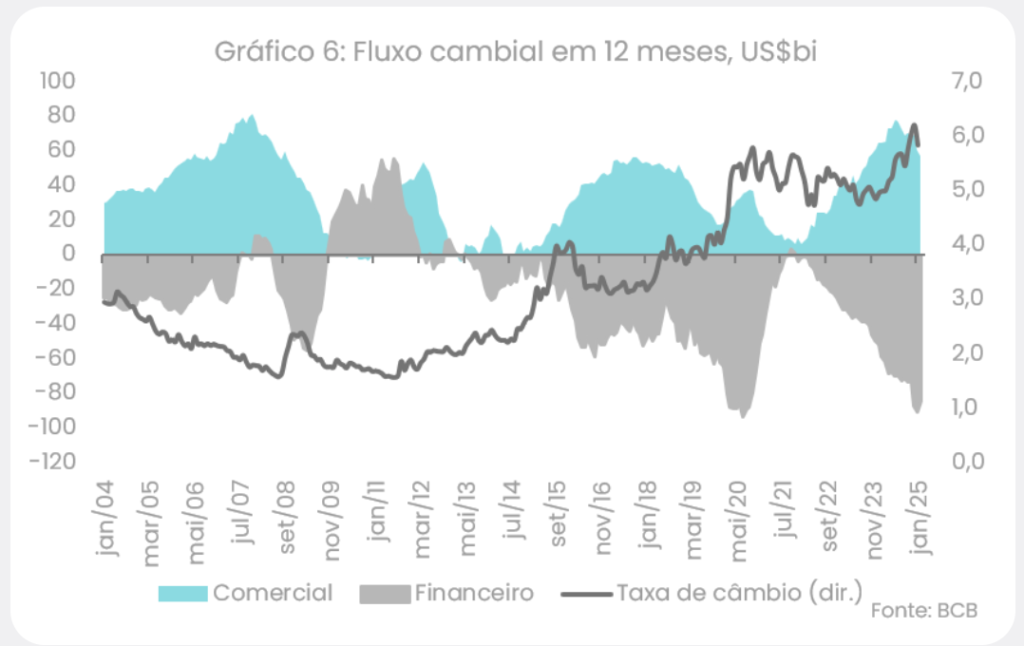

The reader must be wondering what is the connection of this whole discussion above with the behavior of the exchange rate here in Brazil. And the answer for those who follow our content more assiduously is the same as always. As long as the U.S. interest rate remains at the current level, the flow of so-called speculative investments will continue to be directed to the U.S. Although emerging economies (Hello, Brazil!) have more attractive interest rates, the American economy is seen as safer. And interest rates between 5.00% and 5.25% of an economy seen as safe are worth more than the interest rate of 15.00% a.a.de an economy that still faces many challenges, especially in the fiscal field. Therefore, there are few arguments that ensure the inflow of dollars here. And if we don’t have dollars (or we have fewer dollars), the exchange rate remains under pressure (see chart 6).

Conclusion: and for those who reached the end of the reading, hoping and believing that the title of this report would live up to the content, they were wrong. The wonderful scenery will continue to be just part of a famous samba-enredo. In fact, the market projection, according to the Central Bank’s Focus Bulletin, indicates an exchange rate close to US$/R$6.0 by the end of the year. The expectation of maintaining still high interest rates in the US, added to the uncertainties surrounding the Brazilian economy, especially in the political and fiscal field, should contribute to the maintenance of a still high risk perception for Brazil. Not to mention that soon we will be reaching an election year. But that’s a subject for the next carnival!