By Cristiane Quartaroli

It took me a few days to write this report. I had an idea, a bias, but over the past few weeks, everything seems to have turned upside down, ideas became a bit blurred, and the feeling of doubt grew more and more. In other words, if I wasn’t very sure of anything before (we never are!), now it seems even less so. The good part is that against facts there are no arguments, so we can analyze the facts to try to argue with what suits us, choosing our best path – which may or may not be the right one.

The Brazilian economy has improved, that’s a fact. If we analyze the main macroeconomic variables of the first half of this year and compare them with the recent past, we are better off, yes. Of course, some issues still need to be addressed (hello fiscal policy!), but overall we are better off than we were a few months ago. It remains to be seen whether from now on we will keep the glass increasingly full of good things or if the water will run out halfway. Shall we see?

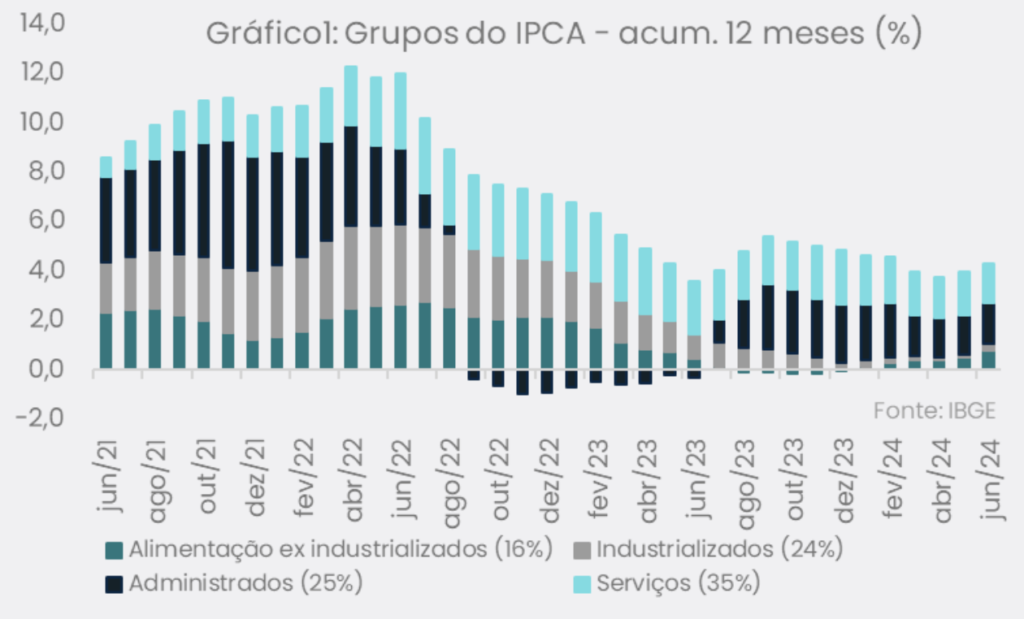

Half Full – Inflation Has Eased. When we look in the rearview mirror, it is clear that there has been an improvement in the inflationary scenario, as in the last two years the accumulated IPCA over 12 months has dropped from a variation of over 11% to something closer to 4.0% – above the target, it’s true – but still, a very positive sign. The reduction in administered prices, as well as the lower variation in items related to food and beverages (see chart 1), were the main drivers of this more benign behavior in the Brazilian inflationary scenario. Remembering that a large part of this movement was related to the drop in our exchange rate during this period (miss those days!!), but also to the effect of contractionary monetary policy – read higher Selic – between early 2022 and late 2023.

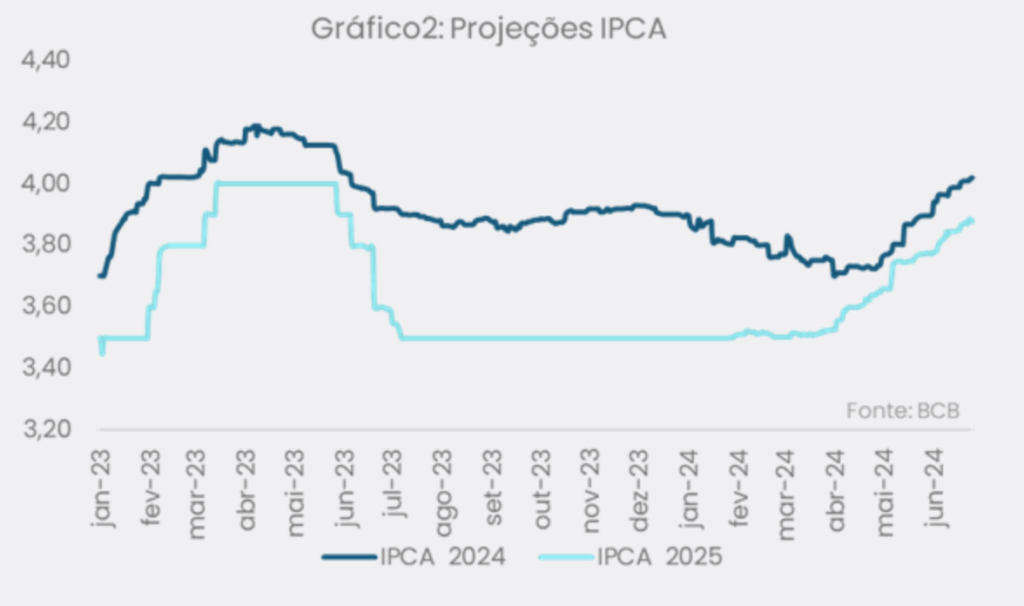

Half Empty – Inflation Expectations Are Rising. Despite the more controlled numbers compared to previous years and after more recent data showed a positive surprise, projections for the IPCA at the end of this year and 2025 have been rising for more than two months (see chart 2). Some reasons justify this behavior, among which we highlight: 1. lack of predictability regarding Brazilian public accounts, especially concerning the evolution of mandatory expenses – the higher the level of expenses, the greater the chance of pressure on future inflation; 2. the exchange rate has been rising more intensely since mid-May and a high exchange rate for a long time tends to impact (although not fully and immediately) future inflation. 3. the impact of the improvement in the labor market on inflation numbers (we talked about this topic in our January special). The higher the income, the higher the consumption, and this, consequently, can negatively reflect in more inflation.

Half Full Glass – The Interest Rate Is Lower. Lower inflation allowed the Central Bank to start the Selic rate cut cycle in August 2023, and since then, our interest rate has dropped from 13.75% to 10.50%. However, the rise in inflation projections for 2025 and uncertainties about Brazilian fiscal accounts led the Central Bank to decide to pause the Selic rate cut in its last COPOM decision, and the glass began to show signs that it might start to empty again!

Half Full Glass: Economic Activity Indicators Surprised Positively. The market has been systematically revising growth projections for 2024. If at the beginning of this year, the expectation was that GDP would grow by about 1.40%, the most current projections signal an advance of more than 2.0%. And indeed, when we look at the higher frequency indicators, the vast majority surprised positively. Retail trade, for example, which was released last week, showed growth of 2.8% until May this year, while in the same period last year this value was 1.4%. The IBC-br itself – the Central Bank’s monthly indicator that provides a sample of what the monthly GDP would be, recorded growth of more than 2.0% for this year, in line with the behavior of the FOCUS projections we mentioned earlier.

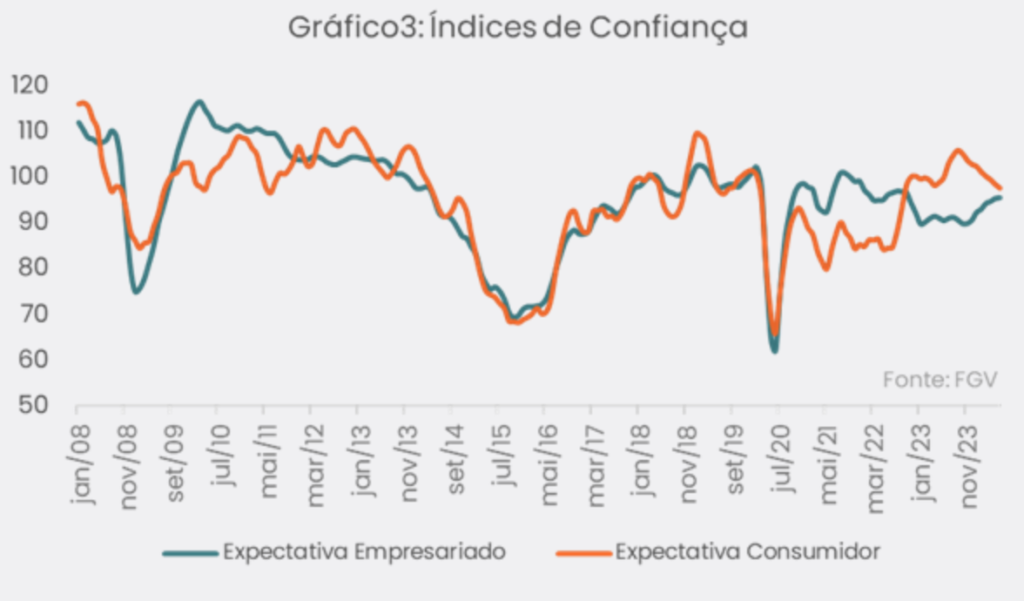

Half Empty Glass: Confidence Indicators Still Do Not Show a Clear Trend. With inflation easing and lower interest rates, it was expected that we would have better-behaved confidence indicators and that, therefore, this would be reflected in a more robust growth level in the future. However, this is not what we have observed, on the contrary. Consumer expectations have recently declined again, signaling that the population is less willing to spend and has doubts about the future of the country’s economy. Business expectations, although improved, are still at a lower level than we observed last year (see chart 3), reflecting concern about the lack of predictability regarding possible progress or not in Brazil’s structural reforms, in addition to the tax reform that is already being addressed. Uncertainty generates a drop in confidence and a drop in confidence can be reflected in lower growth in the future.

Half Full Glass: The International Scenario Has Improved, Especially When We Look at the US. American inflation has shown relief in the most recent data and is already close to the target, and labor market data indicate that the American economy is less overheated. In other words, this is the scenario that the Central Bank expects to be able to start the cycle of lowering American interest rates. Remember that interest rate cuts from central economies (US and Europe) have been expected since the end of last year.

Half Empty Glass: The American Elections Are Just Beginning. Although elections in Uncle Sam’s land do not have a direct impact on our economy, they can generate volatility in global markets, after all, we are talking about one of the largest economies in the world. Events like what happened last weekend (attack on candidate Trump), as well as uncertainties about who will be the next president of the US, generate risk aversion and affect financial assets, so we may continue to see pressure on our exchange rate due to this issue.

It seems that much of the market prefers to look at the half-empty glass today, and who am I to say that this view is wrong when it may indeed prove correct in the future?! But we prefer to give more weight to the side of the glass that is still a little fuller. In fact, we believe that we have more room for improvement than for deterioration, as I mentioned in the arguments above. Maybe it’s stubbornness on our part (it could be) or perhaps a more hopeful outlook (it’s possible), but only time will tell, and we won’t be ashamed to admit we were wrong (if we were wrong, of course!). So, which glass will you choose?